Hey there! Are you a business owner like me? Well, if you are, then you know how important it is to keep track of your finances. Today, I want to talk about a crucial aspect of managing your business’s financials – accounting records and bank statements. Trust me, these documents are game-changers when it comes to staying on top of your business’s financial health.

In this article, I’ll be diving into the world of accounting records and bank statements, and why they are essential for every business owner, just like Luis. We’ll explore how these records help in tracking income, expenses, and cash flow, allowing you to make informed decisions for your business’s growth.

Luis Needs Accounting Records and Bank Statements from A Witness

Having accurate and up-to-date accounting records is essential for any business owner. As the owner of a business, I understand the importance of maintaining proper accounting records. These records provide crucial information about the financial health of my business, allowing me to make informed decisions and plan for the future. Let me explain why accounting records are so important.

Tracking Income and Expenses

By keeping meticulous accounting records, you can easily track your income and expenses. This helps you understand where your money is coming from and where it’s going. Having this knowledge allows you to identify areas where you may be overspending or areas where you can potentially increase revenue.

Cash Flow Management

Maintaining accurate accounting records also enables effective cash flow management. I always monitor my cash flow closely to ensure that I have enough money to cover expenses, pay my employees, and invest in growth opportunities. Your accounting records can help you identify cash flow trends and predict periods of high or low cash flow.

Compliance and Tax Reporting

Another crucial aspect of accounting records is their importance in complying with legal and regulatory requirements. I rely on my accounting records to ensure that I am properly recording transactions, calculating taxes, and submitting accurate financial reports to the relevant authorities. Maintaining accurate and organized records not only helps me avoid penalties and legal issues but also makes tax reporting much easier.

Financial Decision-Making

Ultimately, having comprehensive accounting records empowers you to make informed financial decisions for your business. With accurate financial data at your disposal, you can identify trends, spot opportunities for growth, and make strategic business decisions. Whether it’s determining the profitability of a product or service, evaluating the viability of a potential investment, or forecasting future financial performance, your accounting records serve as a valuable tool in guiding your decision-making process.

Understanding Bank Statements

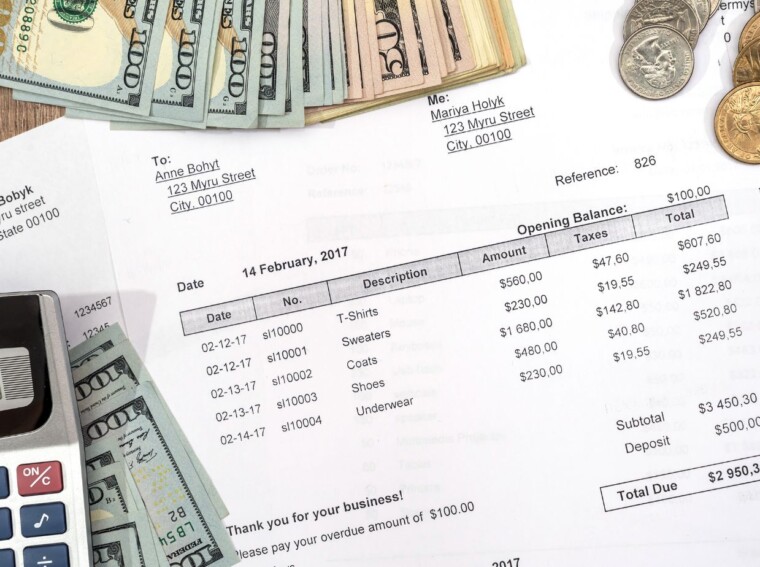

Bank statements are a vital component of maintaining accurate accounting records for any business. They provide a detailed summary of all transactions that occur within a specified period, allowing me to effectively track my company’s financial activities. Analyzing bank statements not only helps me reconcile my records but also provides valuable insights into my business’s cash flow and financial health.

When analyzing bank statements, it is crucial to understand the different components and information they provide. Here are a few key things I consider when analyzing my bank statements:

- Account Summary: The first section of a bank statement typically includes an account summary, which provides an overview of the beginning and ending balances for the designated period. It’s essential to carefully analyze these balances to ensure they align with my own financial records.

- Transactions: The bulk of the bank statement consists of detailed information about individual transactions. This includes deposits, withdrawals, checks issued, electronic transfers, and any fees or charges imposed by the bank. By cross-referencing these transactions with my own records, I can identify any discrepancies or errors that need to be addressed.

- Dates and Descriptions: Each transaction on the bank statement includes a date and a brief description. Paying attention to these details helps me accurately match the transactions with their corresponding entries in my financial records. This improves accuracy and minimizes the chances of overlooking any financial discrepancies.

- Reconciliation: Reconciling my bank statement is a crucial step in ensuring the accuracy of my accounting records. This involves comparing the bank’s transactions with my own records and resolving any differences. Through this process, I can identify any missing transactions, errors, or suspicious activities that require further investigation.

Conclusion

Having accurate and up-to-date accounting records and bank statements is essential for any business owner. Bank statements offer valuable insights into a business’s cash flow and financial health, providing a clear picture of where the money is coming from and going to. By analyzing the account summary, transactions, dates, and descriptions on bank statements, business owners can gain a deeper understanding of their financial situation.

Accounting records, including bank statements, play a crucial role in tracking expenses, identifying trends, tracking tax deductions, evaluating vendor relationships, and measuring profitability.